A landing page with payment gateway can help you maximize your sales opportunities.

Having a streamlined payment process is essential for any business or individual looking to sell products or services online.

Nobody likes to miss out on potential purchases. Whether you’re a seasoned sales funnel user or just getting started, integrating a payment gateway into your landing page is crucial. A payment landing page can help unlock extra sales strategies. You can offer additional products at the checkout, utilize one-click upsells, and provide a smoother user journey.

Don’t get stuck at the starting line. Learn how to integrate a landing page with payment gateway the right way with this blog post.

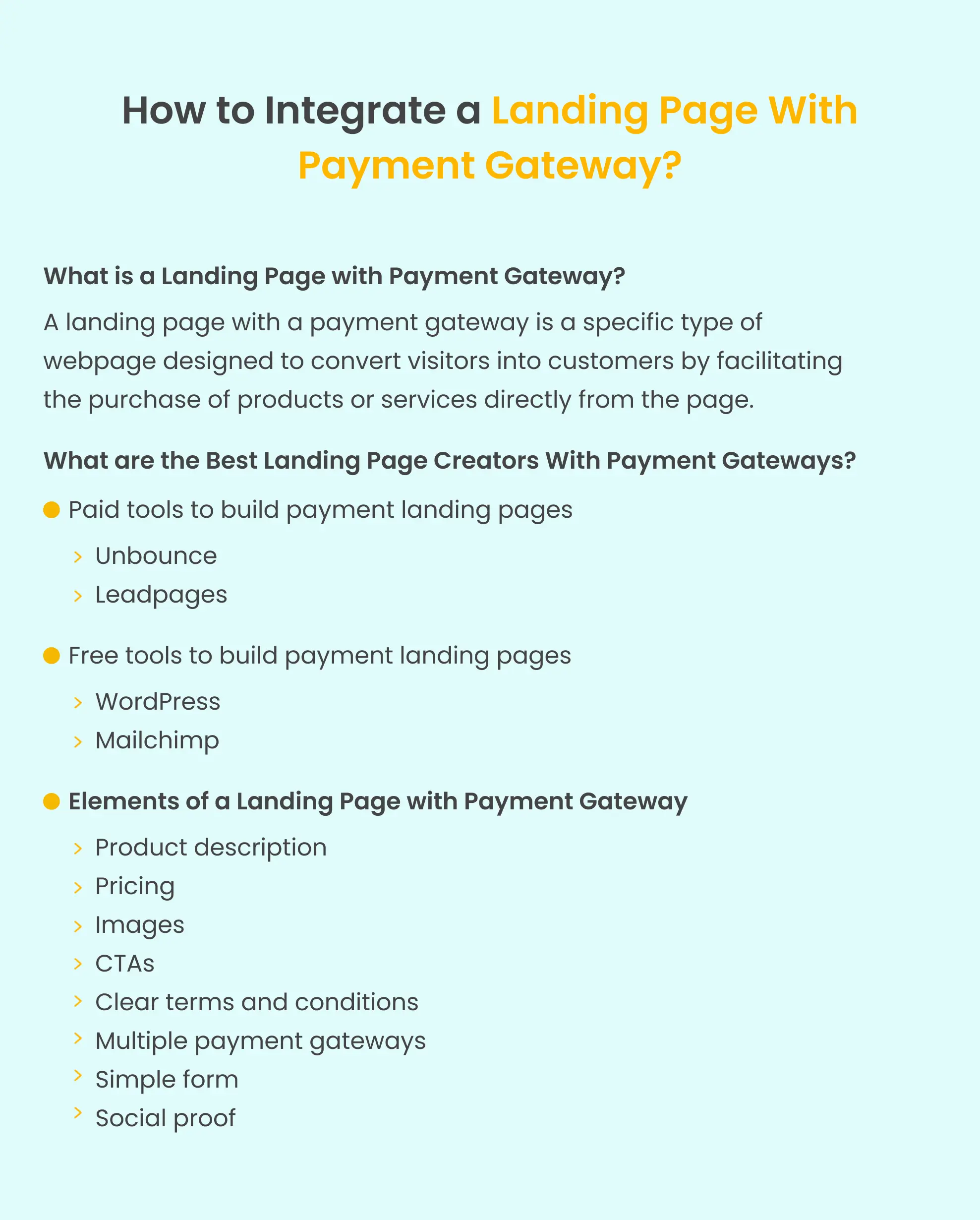

A landing page with a payment gateway is a specific type of webpage designed to convert visitors into customers by facilitating the purchase of products or services directly from the page.

While landing pages are tailored for conversions, a payment landing page serves to seamlessly assist clients in completing purchases of your goods.

The payment gateway lets customers securely enter their payment information, such as credit card details, and complete the transaction without leaving the landing page. This setup streamlines the purchasing process, reducing friction and increasing the likelihood of conversion.

A payment gateway is like a digital cashier for online stores. It securely takes your payment information, like credit card details, and sends it to the bank to ensure you have enough money. Once approved, it completes the purchase, allowing you to buy things online safely.

Landing pages with payment gateways are most effective at the bottom of sales funnels, where they play a crucial role in helping leads become customers. Such landing pages are crucial for all industries be it SaaS, finance, ecommerce, etc. They bring together all the necessary elements for making a purchase decision and provide a smooth transition for leads who have progressed through earlier stages of the funnel like free trial or demos.

For example, engaging with competitor comparison landing pages or service pages.

Additionally, the versatility of payment landing pages extends across various industries and business models:

SaaS companies leverage them to streamline subscription sign-ups.

E-commerce businesses use them to facilitate hassle-free online purchases.

Freelancers and service providers utilize payment landing pages to secure bookings and appointments.

Educational platforms employ them to process course enrollments.

To sell digital products quickly and easily.

When integrating a landing page with payment gateway, there are two primary approaches to consider. First, if you have your own landing page hosted directly on your domain (as a subdomain or subdirectory), or second, if you use a dedicated landing page builder or tool.

In both scenarios, having a dedicated landing page with a payment gateway is crucial to completing your sales funnel from top to bottom. Such pages need to be simple in design and hence, aren’t costly. Let’s explore these situations in detail and discuss the steps to effectively integrate a landing page with payment gateway.

If you have your landing page directly on your domain without using a builder or tool, integrating a payment gateway involves a more hands-on approach. You’ll need to work with your web developer or utilize plugins to incorporate secure payment processing directly into your existing landing page infrastructure.

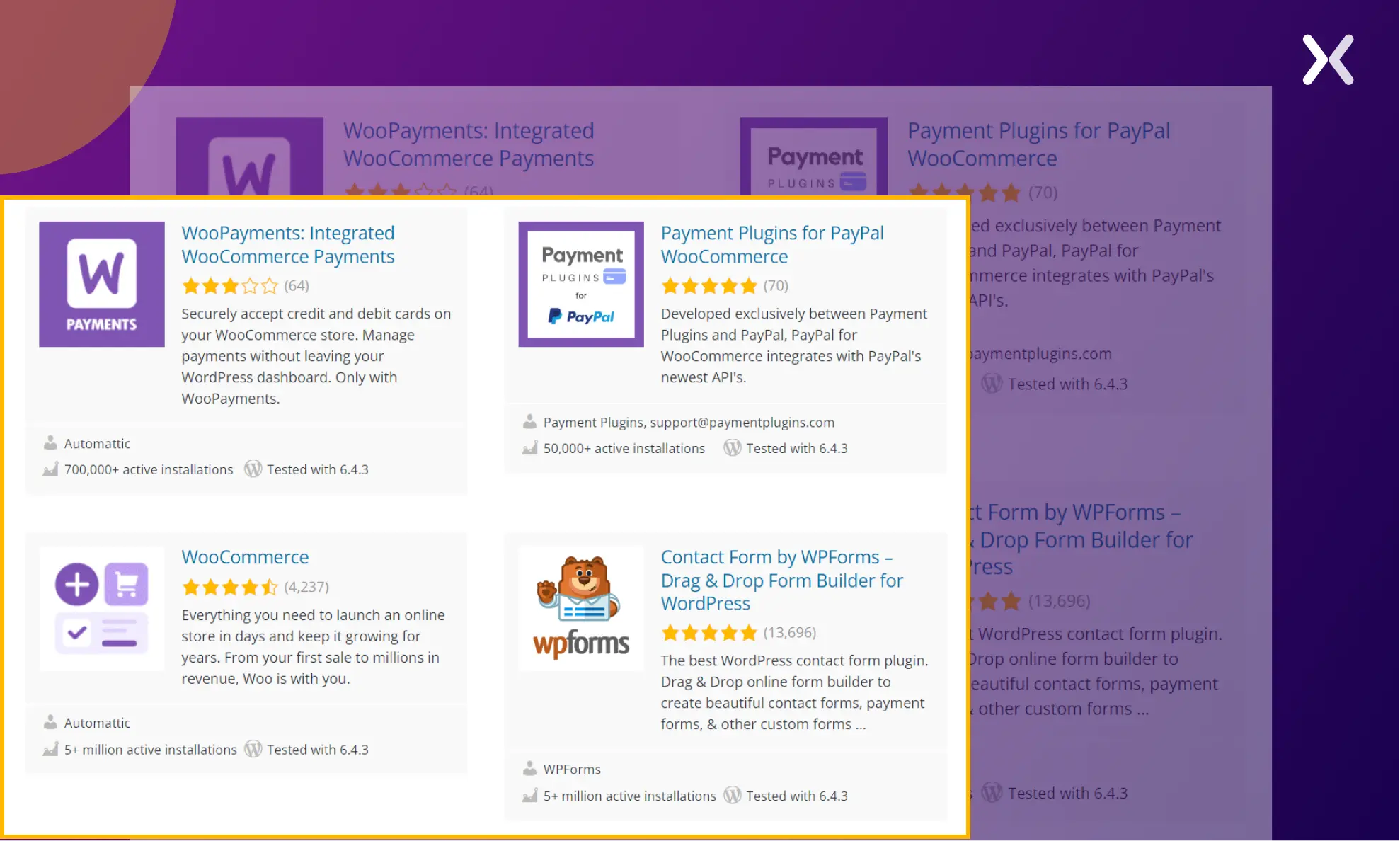

If you’re familiar with popular CMS tools like WordPress, Shopify, or Wix for creating landing pages, adding payment gateways is a breeze with the assistance of plugins.

Alternatively, integrating a payment gateway is often more streamlined if you’re using a dedicated landing page builder or tool. Many popular landing page builders offer built-in payment gateway integrations or seamless compatibility with third-party payment processing services. This allows you to easily add a payment section to your landing page without the need for extensive coding or technical expertise.

Having the right tools can make all the difference when creating landing pages with payment gateways. In this segment, we’ll explore some paid and free options to help you find the best fit for your needs.

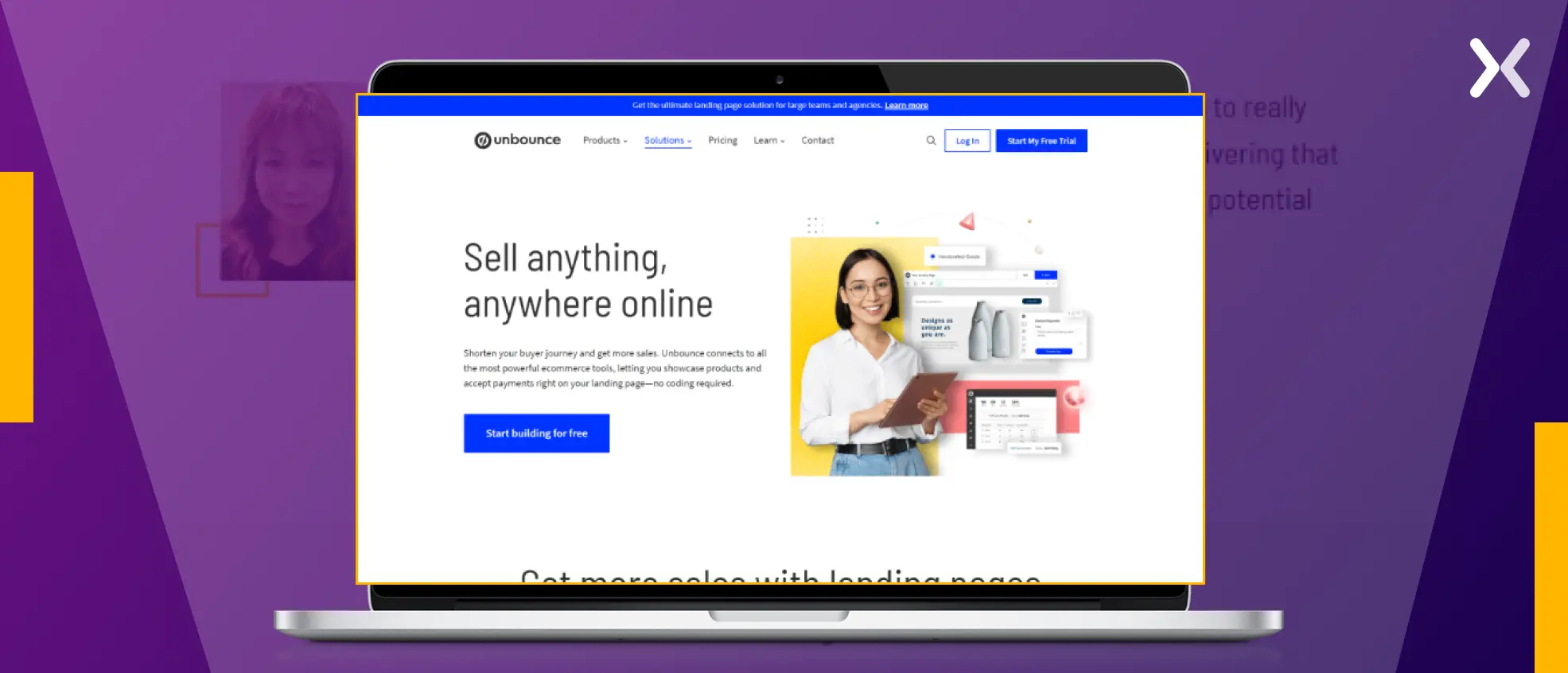

Unbounce is a popular choice among marketers for its drag-and-drop editor and extensive library of templates. With features like A/B testing and analytics, Unbounce helps optimize conversion rates.

It offers seamless integration with various payment gateways, such as PayPal and Stripe, allowing you to easily collect payments directly on your landing pages.

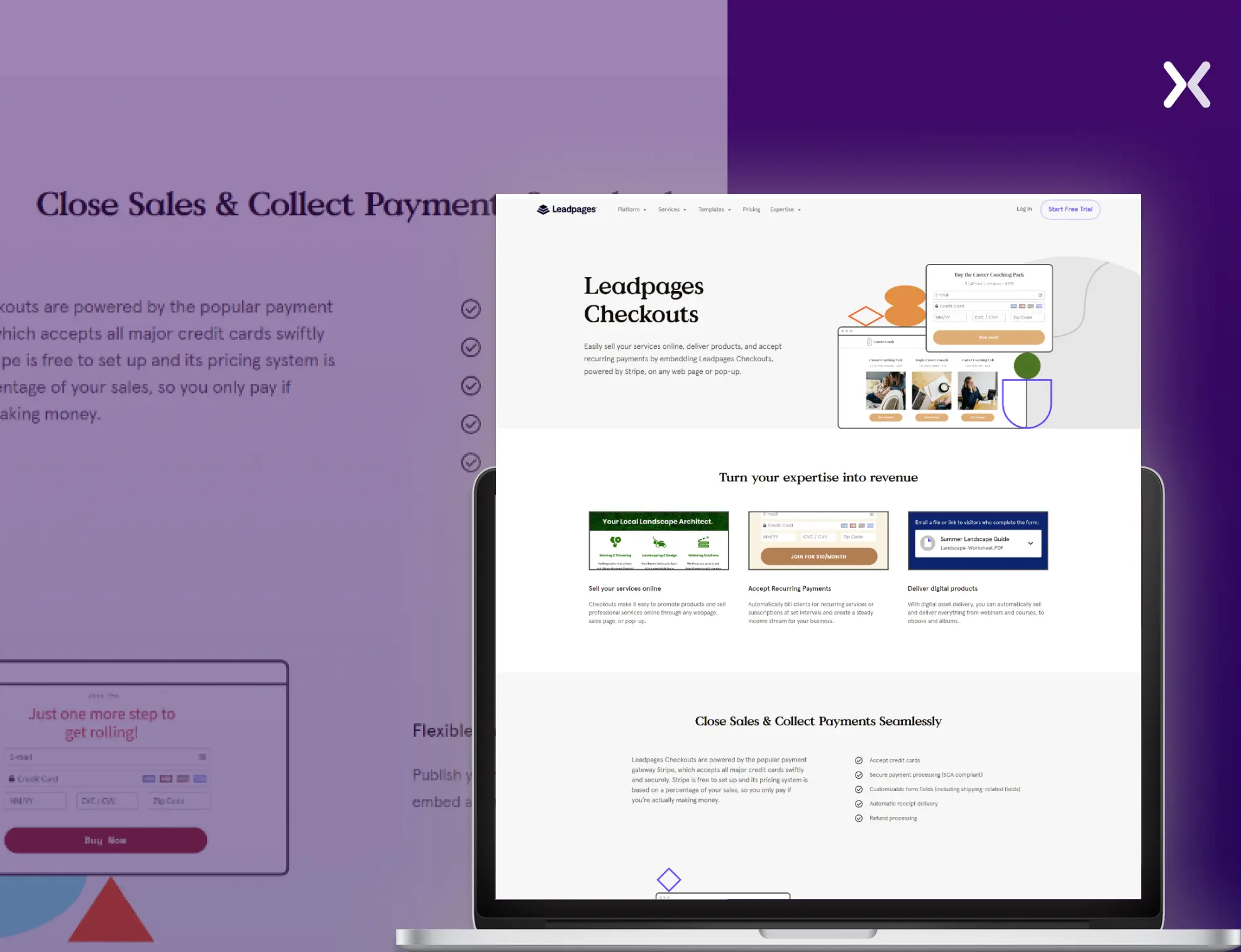

Leadpages is renowned for its user-friendly interface and customizable templates; it is a budget-friendly option for building landing pages. Additionally, Leadpages offers robust tracking and analytics tools to monitor the performance of your landing pages.

It provides built-in payment integration options, enabling you to accept payments effortlessly.

WordPress is a versatile platform that offers numerous plugins and themes for building landing pages. While WordPress requires some technical know-how, its flexibility and extensive community support make it a popular choice among businesses of all sizes.

With plugins like WooCommerce and WP Simple Pay, you can integrate payment gateways like PayPal and Stripe into your payment landing page on WordPress for free.

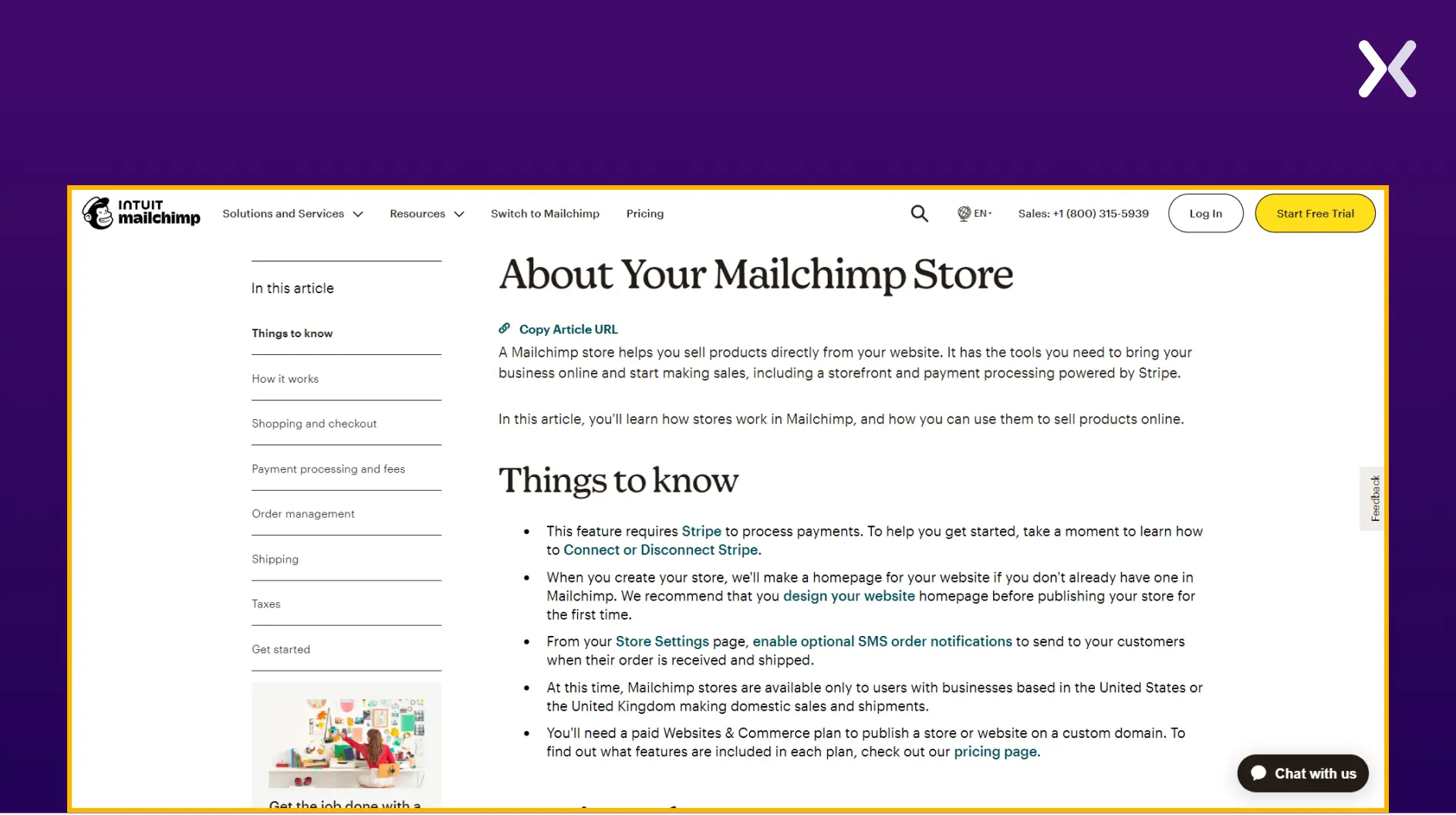

Mailchimp’s landing page builder allows you to create simple yet effective landing pages for free. It seamlessly integrates with Stripe to accept payments directly on your landing pages. While Mailchimp’s functionality may be somewhat limited compared to dedicated landing page builders, it’s a great option for those on a tight budget.

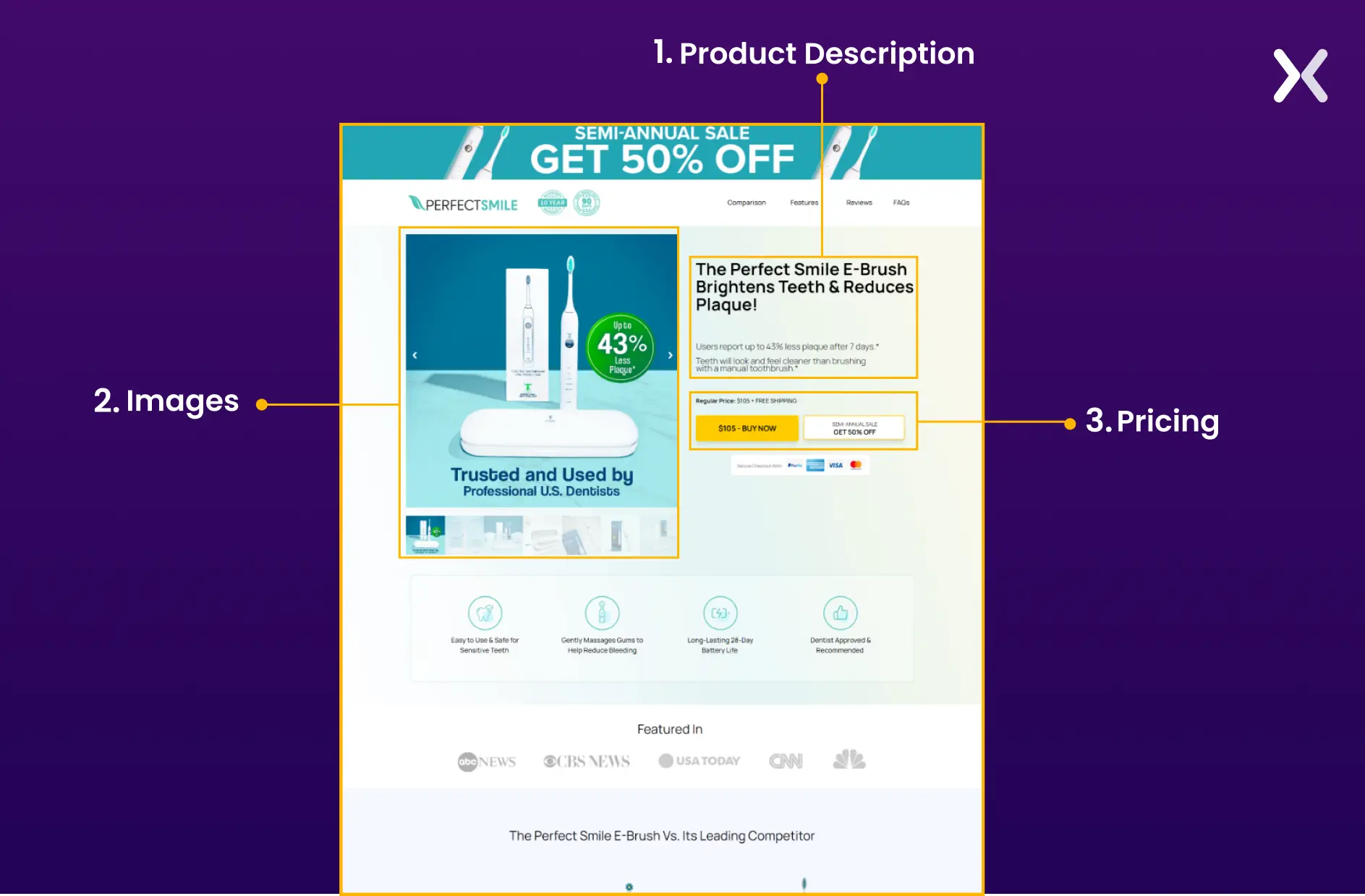

A payment landing page is the final step in the buyer’s journey, instilling confidence in your leads and affirming their decision to proceed with the purchase. To achieve this, certain essential elements must be present on your landing page with payment gateways:

Leads arriving at your landing page with payment gateway are already well-informed about your product or service, having progressed through earlier stages of the buying journey. Now, your focus shifts to providing a succinct overview of the unique selling points (USPs) and key benefits your offering provides.

By effectively highlighting these USPs and benefits, you reinforce the value proposition and reassure leads that they’re making the right decision.

Providing transparent pricing information is paramount for establishing trust with potential customers. When visitors can easily see the cost of the product or service upfront, they are empowered to make informed decisions about whether to proceed with a purchase.

Additionally, it is beneficial to share comprehensive information with your leads, including all associated costs such as shipping fees, taxes, and any other applicable charges. Doing so will streamline the decision-making process and ensure transparency throughout the customer journey. Avoid withholding this information until the final payment stage, as it can disrupt the purchasing flow and make leads second-guess.

It’s important to showcase all the deliverables the lead will receive upon becoming a customer, providing a comprehensive view of the expected value.

Utilizing high-quality images or visuals is imperative for presenting your product or service in its most favorable light. Great visuals in the background and supporting the text help visitors visualize the product and its benefits, making the landing page more engaging and persuasive. Showcase all the deliverables the lead will get once converted into a customer.

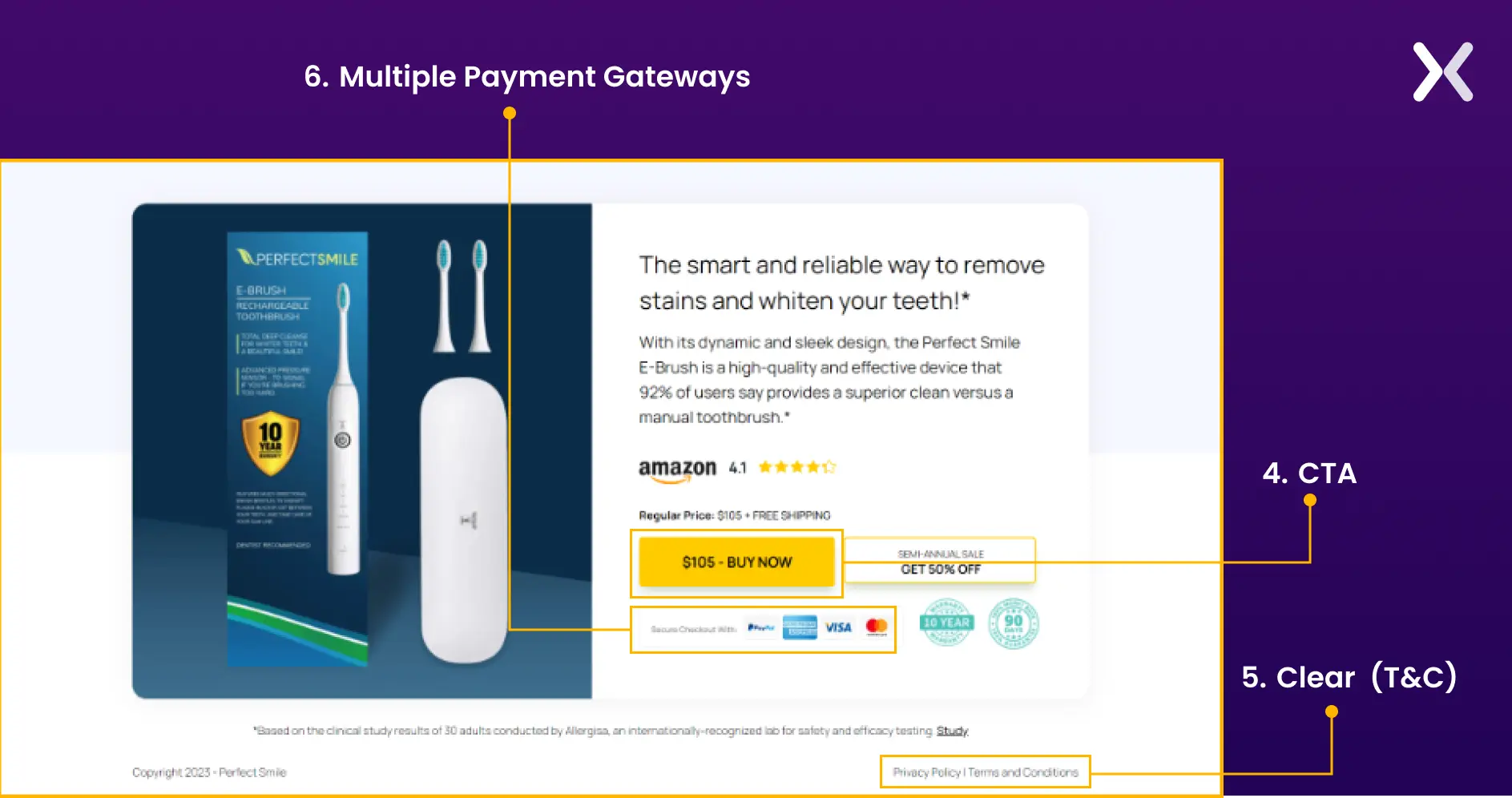

The call-to-action button is the focal point of the landing page and encourages visitors to take the desired action, such as making a purchase or signing up for a service. It should be prominently displayed, and clear communication should be made about what action visitors should take next.

“Buy Now,” “Add to Cart,” “Checkout,” etc., are some of the most common CTA buttons on landing pages with payment gateways.

Providing transparent and easily accessible terms and conditions helps build trust with potential customers. This section outlines essential details such as refund policies, shipping information, subscription conditions, and other relevant details to ensure visitors understand the terms of the purchase.

If you’re offering a guarantee, it’s crucial to make it clear. This not only builds trust but also garners support from people. For example, a 10 or 14-day guarantee can significantly enhance trust.

After the payment landing page, a thank you page is crucial for confirming the transaction and expressing gratitude to customers. It’s also an opportunity to guide them to other areas of your brand, such as your website or social media. This reinforces your brand identity and keeps customers engaged post-purchase.

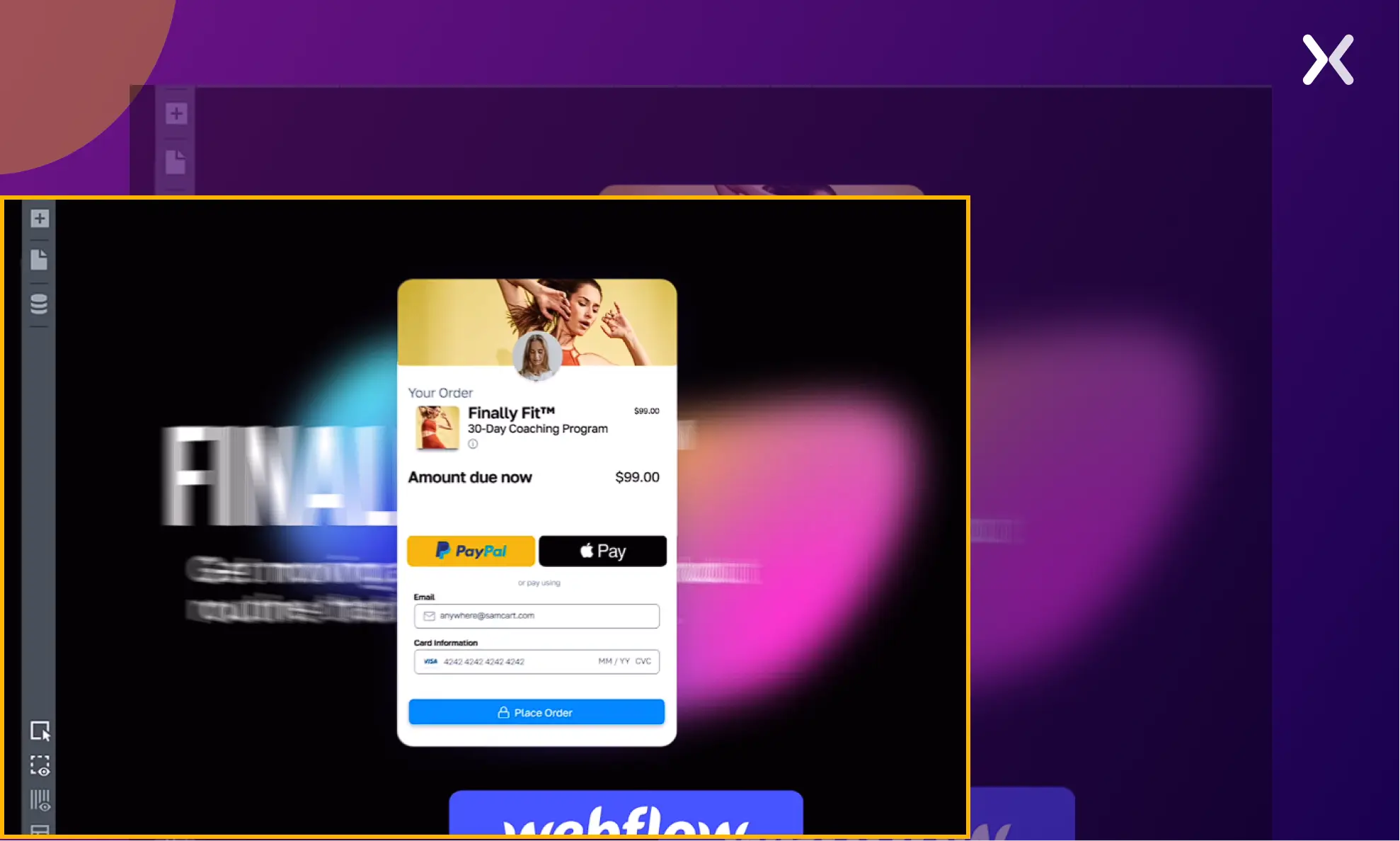

Integrating multiple payment gateways gives customers flexibility and convenience when purchasing. Offering various payment options, such as credit card, PayPal, or alternative payment methods, increases the likelihood of completing a sale and reduces the risk of abandoned purchases due to payment method limitations.

**Pro Tip: **Keep the URLs of your landing page with payment gateway simple and short, avoid using anything spammy looking symbols in them.

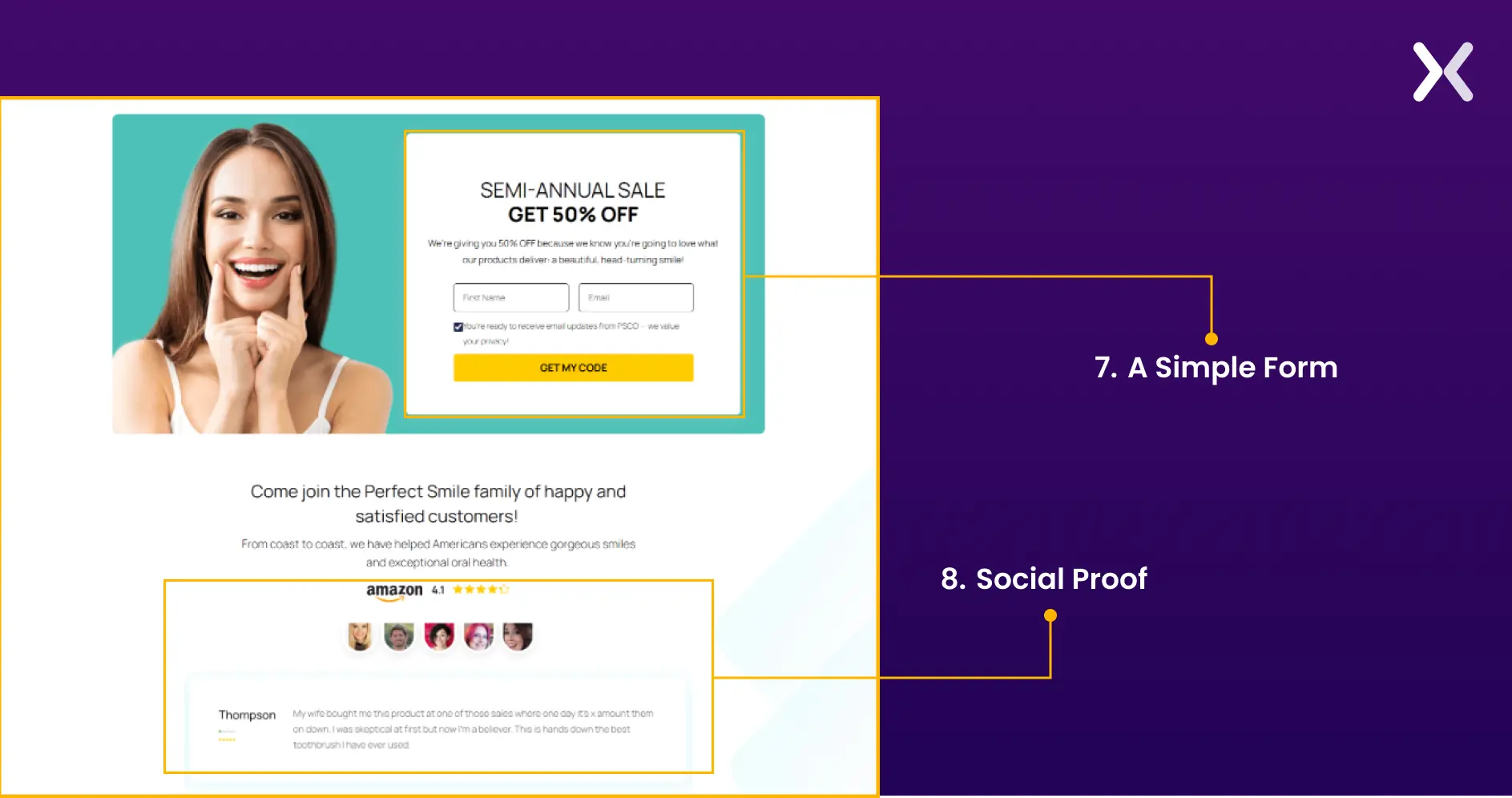

For a payment checkout page, it’s vital to streamline the form and minimize the number of required details. If you’re selling physical products, you must ask for both delivery and billing details. However, simply requesting the name and email address suffices for digital products.

Additionally, it’s crucial to simplify the credit card information entry process and include trust logos. Indicating the supported credit card types enhances transparency and reassures customers during payment.

Social proof, such as customer testimonials and user reviews, is vital in landing pages with payment gateways. These elements provide evidence of a product or service’s value and reliability, reassuring potential buyers and increasing their trust in making a purchase.

Additionally, displaying social media metrics and trust badges further solidifies credibility, helping to alleviate concerns about security and authenticity.

“It's crucial that we have those support contact details right there on the payment page. If something goes wrong with the payment or the page gets stuck, customers need to feel like they can reach out and get help immediately. It's all about making them feel secure throughout the payment process.”

You can use many combinations of products to set a landing page with payment gateways. For this, you need two tools. You can do this with either paid tools or free tools. Here are some options you have for creating a payment landing page quickly.

Here, we also have two options: one where you can use all free tools and one where you can use all paid tools.

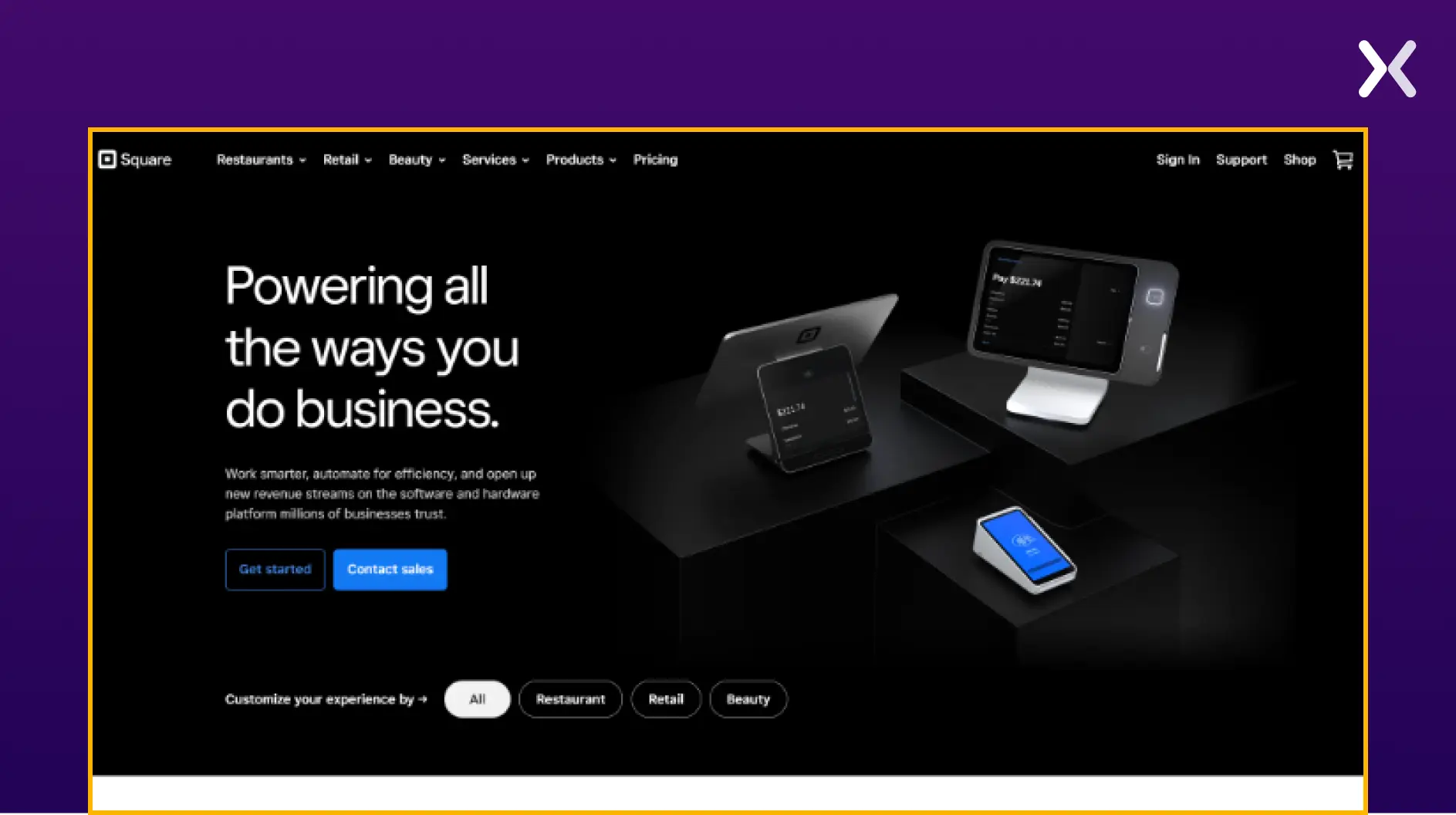

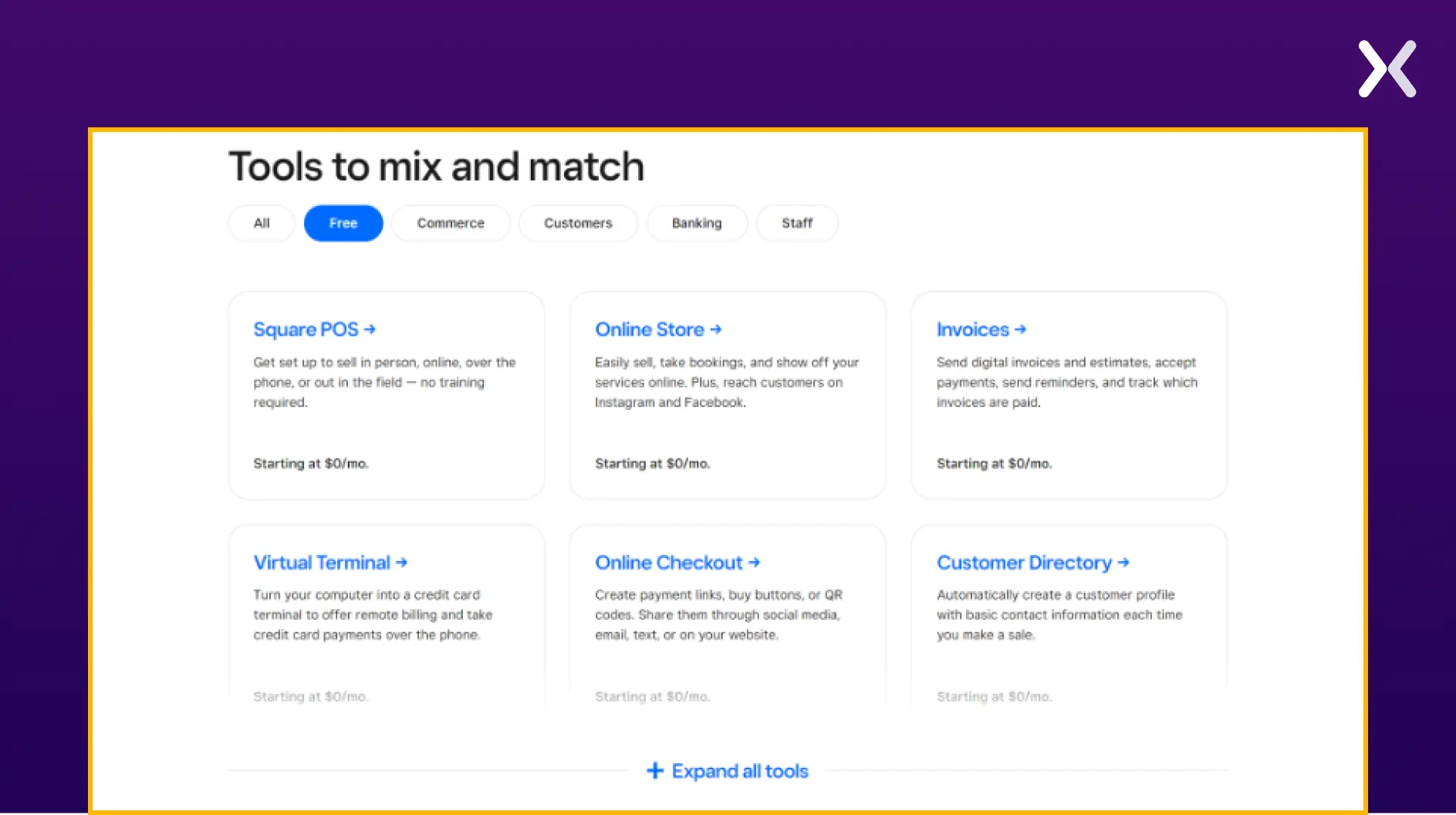

An excellent tool worth exploring is Square—a versatile platform designed to offer payment solutions for diverse businesses.

Beyond its primary function, Square extends its capabilities through its subsidiary, Weebly, allowing users to effortlessly build websites and landing pages. The best part? It’s all free of charge.

Moreover, if you already have a landing page and aspire to initiate sales, Square will facilitate the creation of payment links at zero cost. Their fee structure is straightforward: you’re only charged for the sales you make, while the rest remains free of charge.

Another valuable suggestion is to use Canva to craft your landing page and integrate it seamlessly with a payment link from Square to ensure functionality.

Consider creating landing pages by using premium tools such as Unbounce, ClickFunnels, and Leadpages. These platforms offer dedicated landing page building capabilities along with integrated payment gateways, streamlining the process for your business.

Your primary focus should be on selecting the ideal landing page builder tailored to your specific business needs.

For self-hosted landing pages, you can integrate payment links using Square or utilize another favored tool like:

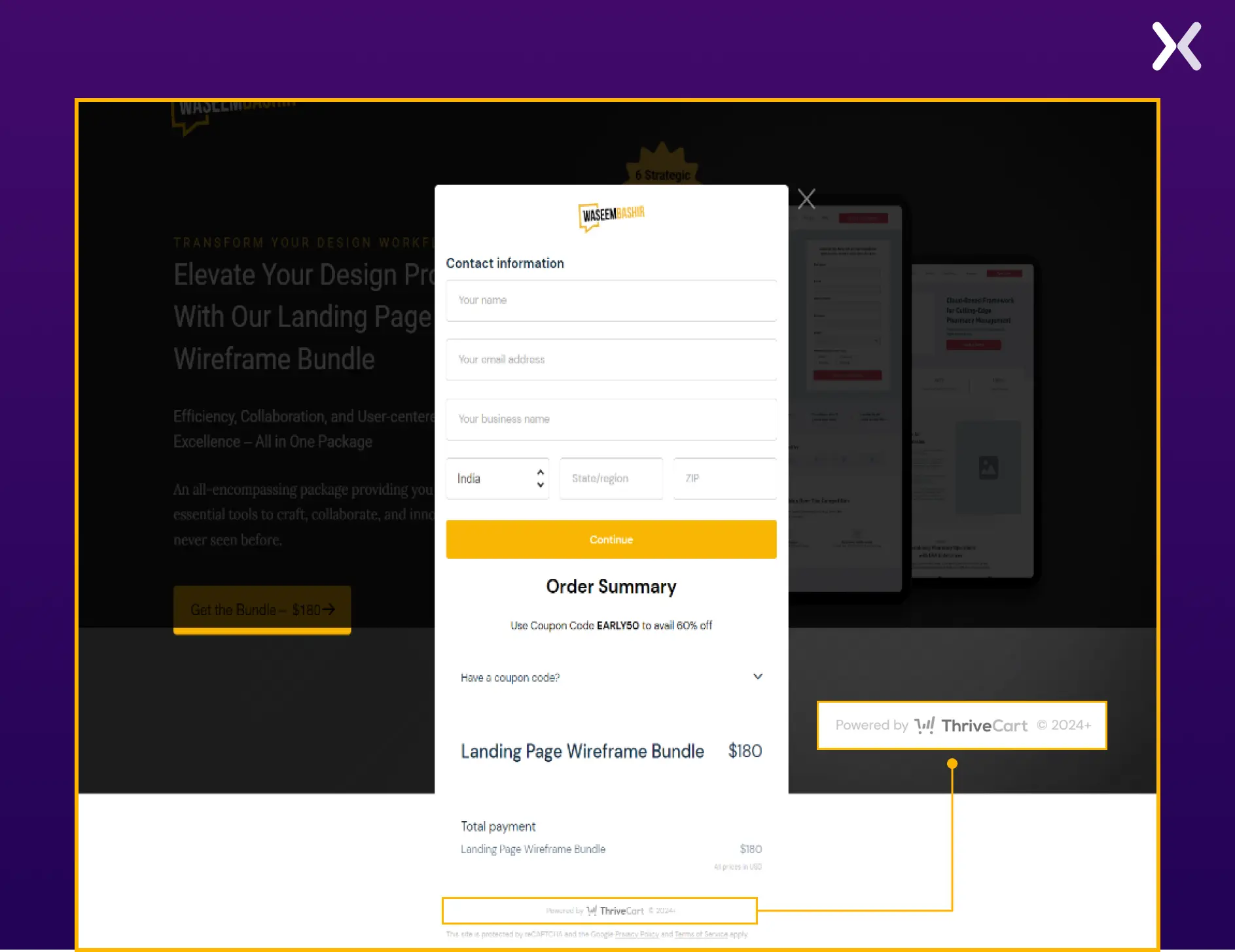

ThriveCart

SamCart

ThriveCart is an innovative page creation platform designed for businesses selling online. It simplifies the process of accepting payments by offering dedicated checkout pages and links.

Moreover, its versatile features, like popups and embeddable checkout options, seamlessly integrate with your website or sales pages.

This platform helps you create seamless cart pages and streamline your sales funnel. It also assists in managing pricing structures and sales tracking while offering robust affiliate management and course creation capabilities.

ThriveCart can be purchased through a one-time payment option, ensuring clarity and simplicity in securing its benefits. Its significant value lies in empowering you to create personalized payment forms tailored to your offers. This enhances your flexibility in building a payment gateway that suits your business needs perfectly.

You can create your landing pages independently and add a ThriveCart check popup at the end to make the whole purchasing process seamless.

“The best practice is to A/B test having a payment gateway versus not. Often you'll see a nice bump in conversions and revenue simply by removing extra steps from the checkout process. Just make sure to clearly communicate security and refund policies to boost trust.”

SamCart is a user-friendly shopping cart platform tailored to simplify online selling for businesses. It offers various features designed to streamline the sales process and maximize revenue potential.

One of SamCart’s notable features is its customizable checkout pages, allowing businesses to create tailored customer checkout experiences.

Additionally, the platform provides various page templates for checkout pages, one-click upsells, and more, making professional-looking page design effortless. The platform supports multiple payment gateways, ensuring secure transactions. It also has a built-in affiliate program feature that enables businesses to leverage affiliate marketing for expanded reach and increased sales.

SamCart’s focus on maximizing sales and its beginner-friendly interface sets it apart.

Additionally, SamCart includes abandonment cart recovery features, helping businesses recover potential lost sales by targeting customers who abandon their carts during checkout.

SamCart is an invaluable tool for businesses seeking to optimize their online sales efforts. It offers user-friendly features that drive revenue growth and customer satisfaction.

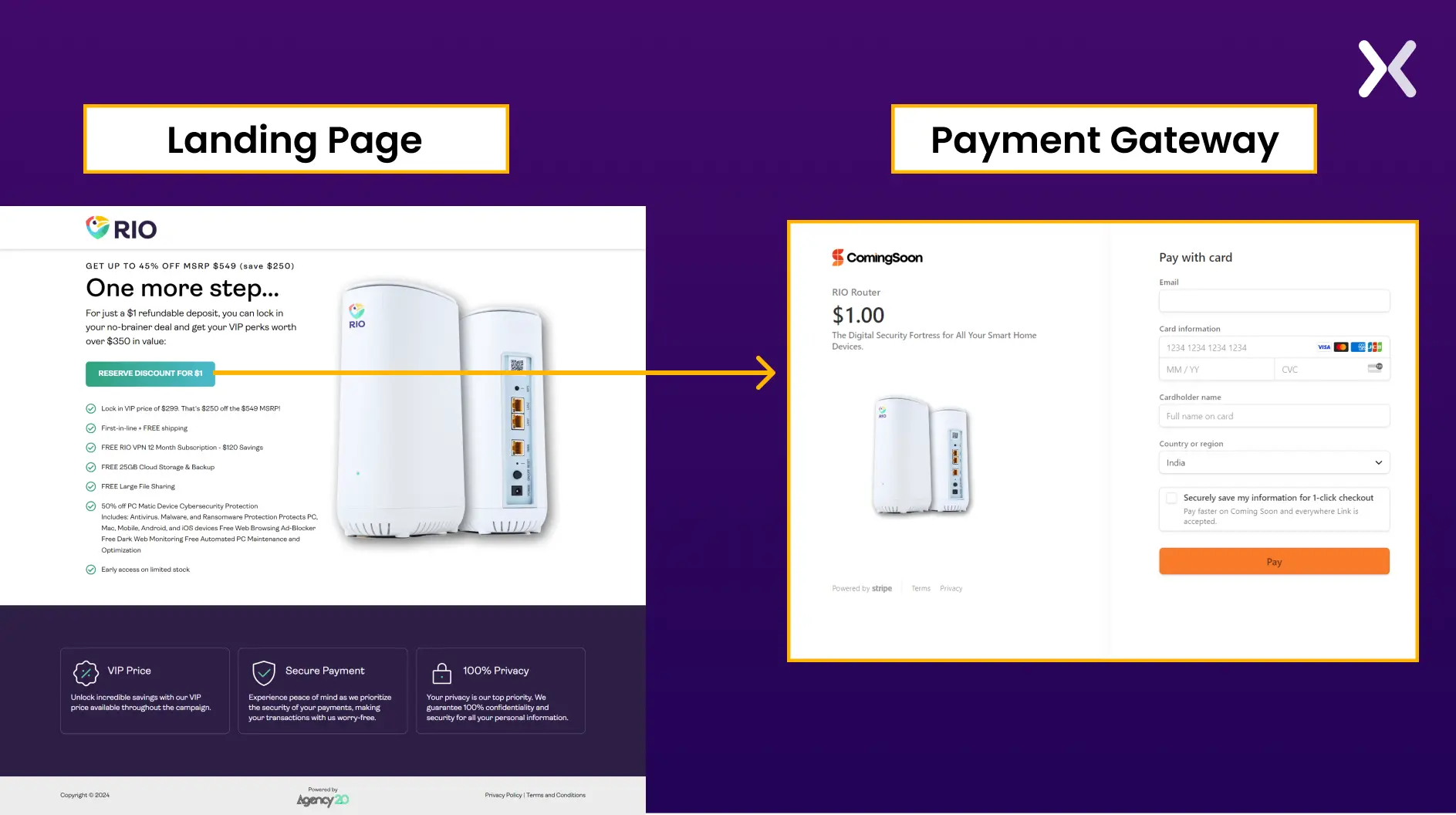

We recently designed a comprehensive funnel for our esteemed client, Agency 2.0. This funnel harnesses the power of a landing page seamlessly integrated with a smooth payment gateway. This setup is meticulously crafted on WordPress, leveraging Stripe checkout functionality to ensure a seamless payment experience.

The funnel begins with an engaging pre-launch landing page that strategically showcases the product’s unique selling points (USPs). It encourages visitors to reserve the product with a nominal $1 deposit, accompanied by transparent terms and conditions seamlessly integrated into the call-to-action (CTA) section, leaving no room for uncertainty.

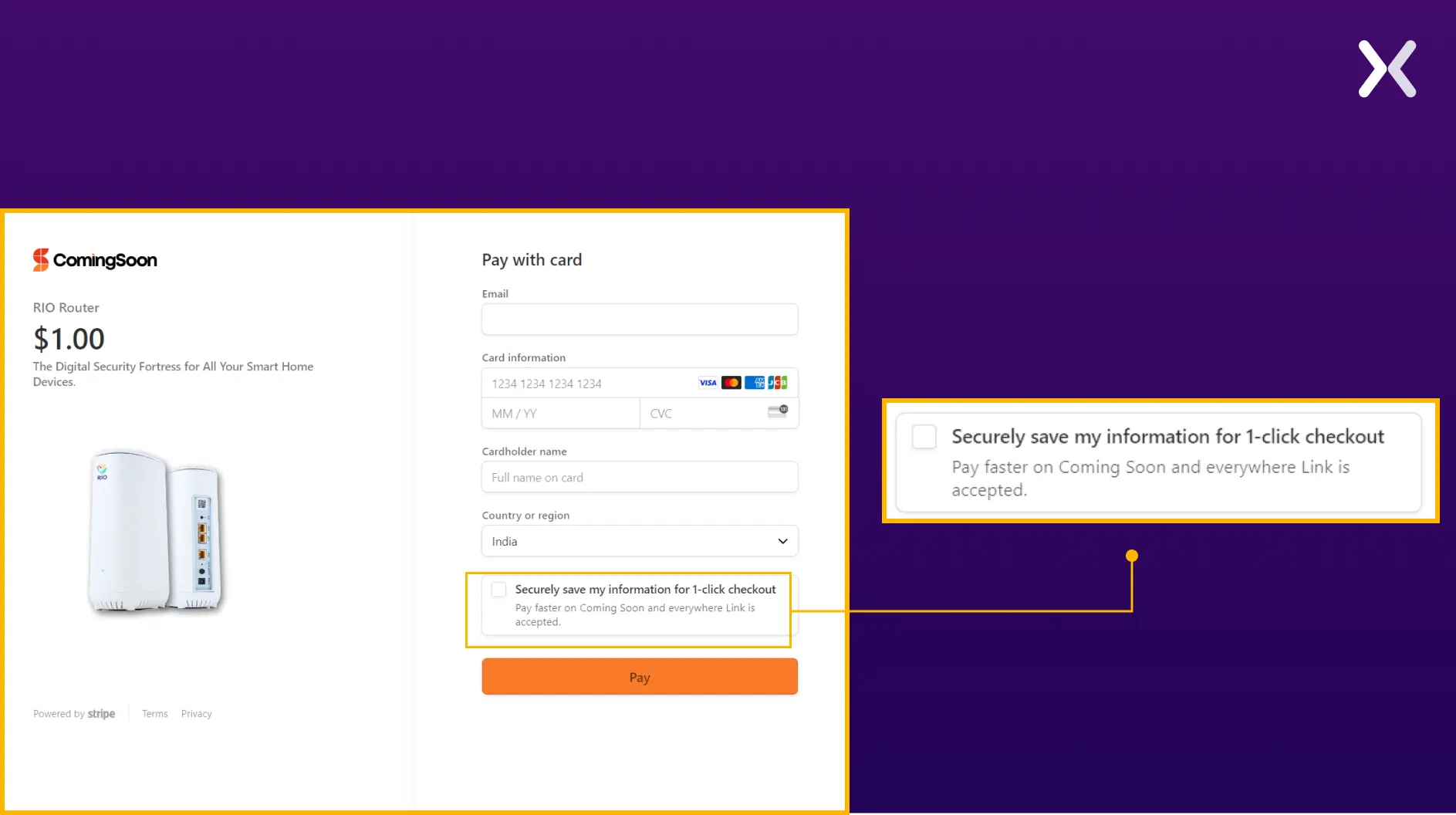

Upon clicking the CTA, users are seamlessly redirected to a payment landing page powered by Stripe checkout. This page offers a variety of payment options and provides a straightforward and user-friendly interface that promptly guides users through the payment process. From the moment users land on the page, they’re presented with a clear path to completing their transaction, ensuring a frictionless experience from start to finish.

What’s more, at the end of the payment process, there’s an option that asks for consent from the payer to securely save their information for future payments. This empowers the payer by giving them a choice to opt in or opt-out, ensuring they have complete control over their payment preferences. It’s all about providing options to the customer, ultimately enhancing their overall experience and satisfaction.

Integrating a landing page with payment gateways is the most straightforward method for collecting payments. With many paid and free platforms, you can effortlessly embed payment forms or links directly onto your landing page.

Such a streamlined approach facilitates seamless customer transactions and enhances user experience. Providing a convenient and secure payment process instills trust and encourages higher conversion rates.

Therefore, whether you opt for a paid solution or explore free options, integrating payment gateways ensures that your landing page effectively drives sales and maximizes revenue.

We have 100+ blog posts on landing pages at your disposal that can help you create landing pages with better conversion rates. Learn how to optimize and analyze your landing page for success.

Making a landing page with a payment gateway might require expert assistance. Get the help you need. Book a call with one of our landing page experts today.

Explore our landing page portfolio to uncover elements hindering your conversion rates. Filter by industry and find which landing page resonates the most with your brand.

Yes. You can use platforms like ThriveCart or Square to accept payments on landing pages.

Related Articles:

Drive More Sales or Leads With Conversion Focused Websites and Landing Pages

Get Started

In today’s fast-paced digital world, having a responsive website is no longer just a nice-to-have, it’s essential. Whether...

As artificial intelligence continues to evolve, businesses are finding innovative ways to enhance their marketing efforts. One of...

Get quality posts covering insights into Conversion Rate Optimisation, Landing Pages and great design