Traditional marketing methods, such as TV campaigns or billboards, may be eye-catching enough to attract a customer’s attention. These methods, however, don’t allow you to track customers and communicate with them after they’ve seen the ads. Post-awareness communication is essential in fully maximising sales potential.

Financial lead generation campaigns need to marry brand-awareness and data capturing. Financial lead generating landing pages are the fundamental tool for achieving this. No matter what kind of digital marketing campaign you are running - directing your customers to well-optimised, conversion-focused financial lead generating landing pages will help you get your prospects into the sales funnel.

Clients are more knowledgeable than they have ever been. The self-directed buyer has all your information, and that of your competitors, at their fingertips. Modern lead generation efforts have to break through the white noise to grab the customers attention.

Trust is another barrier to lead generation, particularly in the finance sector. Online scams are a vicious reality. In 2019, American consumers reported a loss of $1.9 Billion, due to cybercrime. When running a digital financial lead generation campaign, you have to work that much harder to build trust with your audience.

It has a bigger impact on the financial sector because you are not merely selling a product: you are asking people to trust you with their money - their livelihoods. When moving online, the buyer loses the opportunity to look at a sales agent in the eye and assess their intentions. This is what makes first impressions so important and why it is essential to get your financial lead generating landing pages right.

Landing pages are self-contained web pages that customers are directed to after following a link - whether from an ad, email or social media post. Paid Search landing pages are usually campaign-specific. Each landing page has a call-to-action (CTA), something you are asking the viewer to do. For lead generating landing pages, the CTA involves the user filling in their information - often in exchange for something like a free ebook or webinar.

The goal of your financial lead generating landing pages is not to drive for sales - or at least not directly. The goals are:

To generate quality leads

Minimising cost per lead

Maximising conversions

Building overall brand awareness

A lead doesn’t necessarily have to be sales-ready. Someone who has taken the time to look through your financial lead generating landing page and fill in their details has shown genuine interest in your brand. They might not be ready to buy right now, but they could buy in the future.

We can, however, streamline the sales process by qualifying leads. If you look at your current customer base and divide them according to demographic, geographic and behavioral markers, you can create a description of your ideal lead - also called your buyer persona. Your sales team can then focus on leads that fit into your buyer persona.

By way of example, if you were in the wilderness looking for a fire, you are more likely to find it, if you go to areas where you see smoke, instead of blindly searching. In the same way, the buyer persona directs your search for new business. A high-quality lead is someone who matches your buyer persona and has shown interest in your company by completing your CTA.

Identifying quality leads is most successful when it is approached systematically. BANT is a simplistic qualification method. BANT brings up four key factors to determine each lead:

Budget - determine whether they can afford your product.

Authority - determine whether they have buying power. This is particularly important when dealing with B2B clients.

Need - is there an urgent problem that you can help the lead with.

Time - map out a timeframe for a potential sale.

Your financial lead generating landing pages need to be designed with your buyer persona in mind. You can attract high-quality leads by showcasing real problems faced by your buyer persona. Dive into the problem and really flesh it out to show prospects that you understand them - setting you apart from other financial services. Next, present your company as a viable solution. Your unique solution helps you to draw your leads in.

In addition, you need to be able to discern, which leads are high-quality. To maximise the potential of your financial lead generating landing page, you need to have an efficient lead qualification process. You can easily achieve this by using lead scoring software, e.g. Fresh Sales and Engage Bay.

Users are usually loath to give out their contact information because everyone hates spam. Your financial lead generating landing page can bypass this weariness by offering the visitor something of value - a lead magnet. It needs to be presented in such a way that the visitor feels that it is worth giving out their information. Better yet, your visitor should feel like they are getting a bargain, as though their personal information is a small price to gain such value.

Your financial lead generating landing page is the way you package the solutions your firm offers. It is essential that your packaging draws the visitor in and showcases the valuable solutions your brand offers.

Here is a list of key elements to include in your financial lead generating landing pages to ensure that it’s fully optimised:

We have gone into some detail into the importance of having a lead magnet and corresponding CTA.

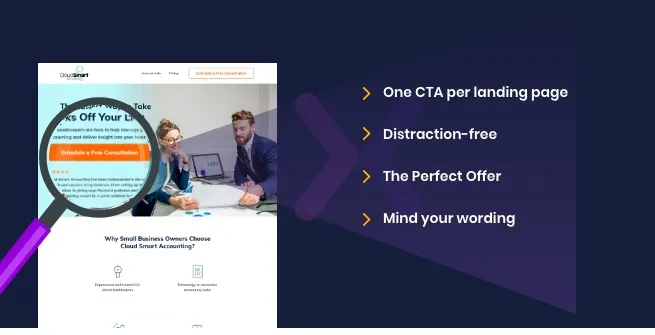

One CTA per landing page. As mentioned, landing pages are campaign-specific. Each landing page should have one self-contained goal and, therefore, one CTA. Having multiple CTAs can drastically decrease conversion as the user can become overwhelmed, and converting users are split between several actions. It means that each CTA will have a poorer conversation rate than several well-optimised landing pages each focused on one CTA.

Distraction-free. Your financial lead generating landing pages should have no external or internal links. You don’t want visitors to navigate away from the landing page before they can follow through with the CTA.

The Perfect Offer. Avoid generic CTAs such as ‘subscribe here’. Lead magnets such as a free e-book, webinar, or course can encourage the user to part with their information. Although not all financial lead generating landing pages use a lead magnet, they can be very effective for increasing conversion.

Mind Your Wording. Avoid aggressive or exaggerated phrasing of your CTA, as it can detract from your message and decrease trust. For example, “Click here to learn the secret of becoming a millionaire in your twenties” just sounds like a scam. A much better way of phrasing your CTA would be “Download our free ebook - Financial Management for Young Professionals”.

Your financial lead generating landing pages need to have a clear and attention-grabbing headline. Research done by Google suggests that it takes 50 milliseconds for a user to make a decision about a web page. So you have less than a second to convince the user not to back click.

Ideally, your headline should be simple and to the point. Importantly it must match the message in the ad that directed the user to one of your financial lead generating landing pages. If your ad promises a free ebook and the user gets to the landing page, and there is no mention of an ebook - your campaign loses credibility.

The length of your financial lead generating landing pages is less important than the quality of the copy. The user should be able to quickly scan through the copy and clearly see how your solutions address their needs. Again, it’s imperative that the copy correlates with the ad, headline, and CTA.

Incorporating videos and pictures create additional means for attracting your viewer’s attention. In fact, eye-tracking studies show that users spend large portions of their time on a webpage’s main images. Extra or decorative images, on the other hand, are almost completely ignored by the user.

All the content on your page helps your audience to define your brand. Studies show that images with people as the main subject tend to create a sense of trust. Many buyers want to connect to the people they are buying from. This desire is particularly important in the financial sector. By incorporating relevant images showcasing your team, you give the viewer someone to connect to.

Videos are another great way to connect with your audience. A short video clip, even one that is less than a minute, can replace large quantities of text allowing you to create a more digestible landing page that is still filled with high-quality information. Don’t have videos that autoplay when the user lands on your page. It is seen as intrusive and reminds the user of annoying pop-up adverts.

Most users are already wary of giving out their personal information. So, if they are confronted by a cumbersome form that requires a wealth of personal details, they are not likely to convert.

Multi-step forms are an elegant solution to this problem. By asking the user only a few questions at a time, they may be more willing to give information. This method is often called ‘making micro-commitments’.

As a rule of thumb, don’t ask for more information that is strictly necessary to qualify leads. Ensure that all questions are written in plain, simple language. Making the form easy to fill in is also important - dropdown menus and multiple-choice options are effective. Try to avoid asking the client to type out long cumbersome answers.

There are several ways to build trust with your audience. Here are some effective methods:

Include a link to a trust index on your financial lead generating landing page - for example a Trust Pilot.

Include testimonials from satisfied customers.

Have a transparent privacy policy that is visible

Although it is not advisable to have social media links, you can have a social media counter on your page showing how many followers you have on different platforms.

Once your financial lead generating landing pages are set up, it doesn’t mean that they are completely perfect. There is always room for improvement. When you are designing a landing page, you make your best guess as to what will attract your customers - albeit a well-informed guess.

By using landing page testing techniques, you can track the success of your financial lead generating landing pages - and continue to optimise them through the entire lifespan. Common tests include split testing and multivariate testing. These are both based on the same principle. You launch more than one version of your landing page.

Each of these versions will have slight differences, such as the position of the CTA button. When the user clicks the ad, they are randomly sent to one of the versions of your page. Over time the conversion rates of the different landing page variants can be compared, and the most successful version can then be used.

Financial lead generation can be more complex than in other sectors. Financial lead generating landing pages become an essential tool in your lead generation campaign. It’s important that you have experts on your team to maximise your potential lead generation. At Apexure, we are well versed in creating financial lead generating Unbounce landing pages for companies of all sizes.

Related Topics:

Drive More Sales or Leads With Conversion Focused Websites and Landing Pages

Get Started.png)

Building a high-ticket coaching funnel for an expertise-driven brand requires a very different approach than traditional marketing funnels....

In today’s fast-paced digital world, having a responsive website is no longer just a nice-to-have, it’s essential. Whether...

Get quality posts covering insights into Conversion Rate Optimisation, Landing Pages and great design